SmartPath Predictive Technology™ Case Studies

Meet Philip. This is his story.

Name : Philip Cook

Location : Austin, Texas

Exam sections passed : AUD, BEC, REG, FAR

Education: Texas State University

Work: Staff Accountant at Baker Tilly Virchow Krause, LLP

Philip's CPA Exam experience

Testing Attempts

| Exam Part | Testing Date | Score |

|---|---|---|

| FAR | 8/12/2017 | 88 |

| AUD | 12/09/2017 | 84 |

| BEC | 01/06/2018 | 89 |

| REG | 03/10/2018 | 82 |

Philip's Original — Exhaustive Approach

For the first three sections of the exam Philip took the exhaustive approach that many students take while preparing -- he did everything.

"I worked through just about every single question to make sure I was getting the coverage that I needed"

While this approach can be effective (as shown in Philip's case, having passed all sections on the first try), it may not be the most efficient.

How SmartPath Technology™ helped Philip

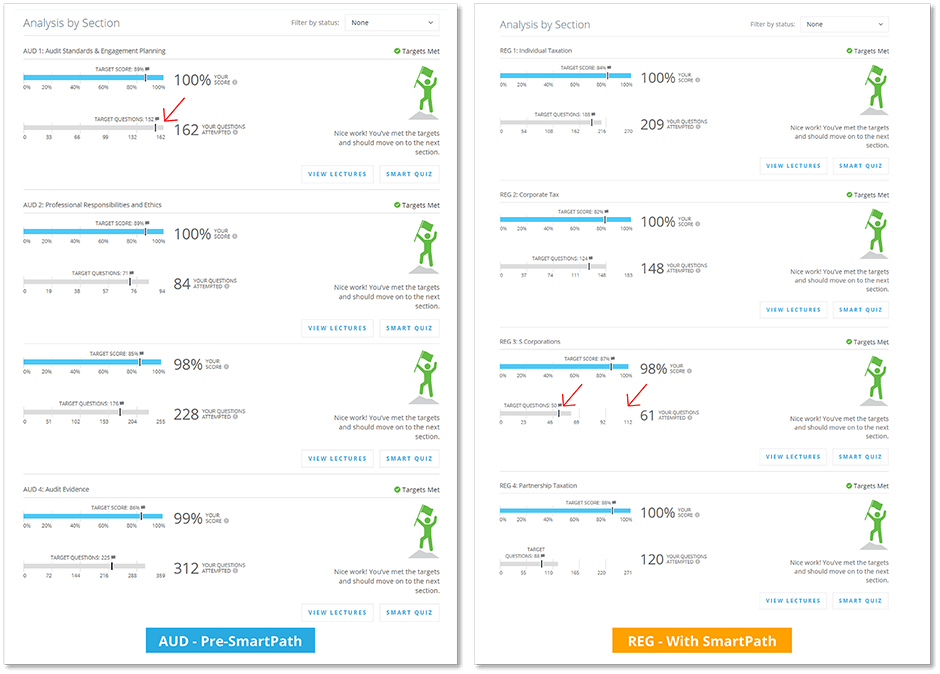

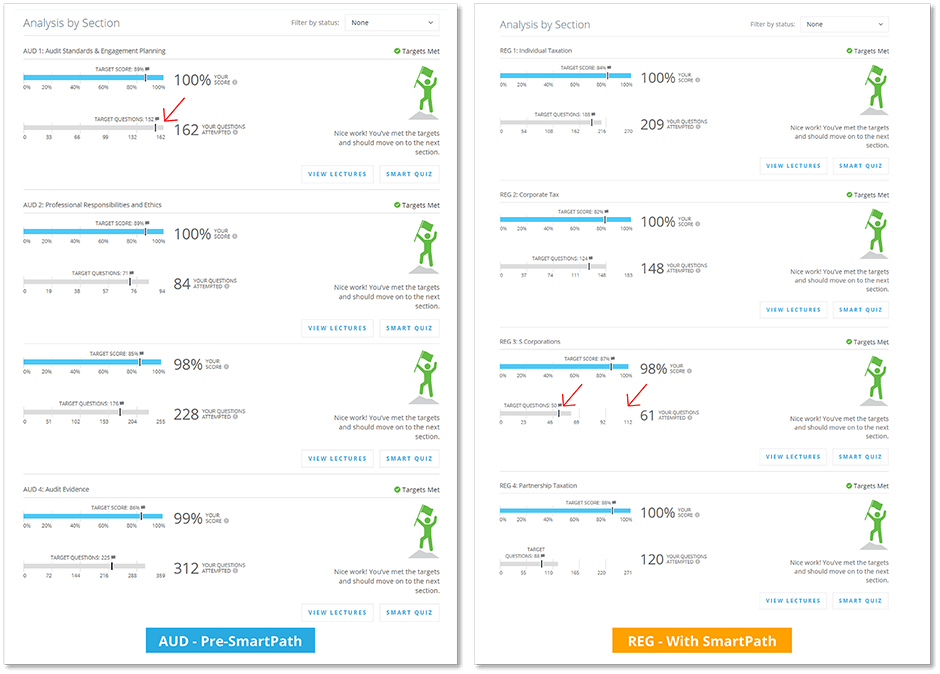

Figure 1a: (Left image) The image shows Philip's data from AUD, which he sat for prior to the release of SmartPath. Because these targets were not available to him at the time, he felt the need to complete as many questions as possible. The example indicated by the arrow shows that he went through all 362 available quetions and in AUD 1 Standards & Engagement planning.

Figure 1b: (Right image) Conversely, Philip took advantage of available targets when preparing for REG. As indicated here, her was comfortable enough to cut himself off at 61 questions in REG. AS indicated here he was comfortable enough to cut himself off at 61 questions in REG 3: S Corporations, even though there were a total of 112 available questions.

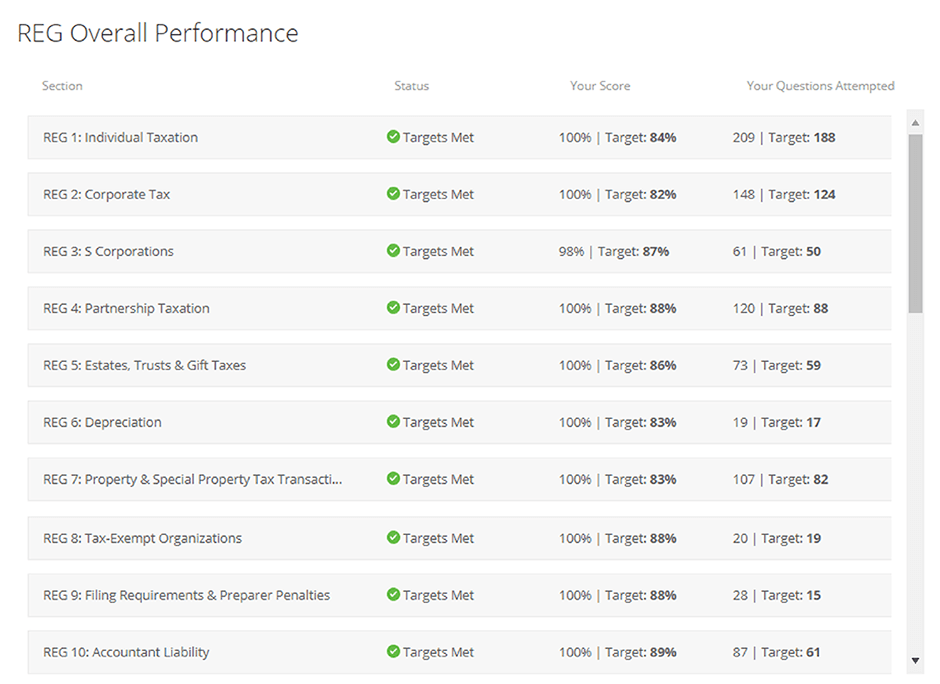

Figure 2 : Here is a snapshot of Philip's REG SmartPath data right before he took the exam. All targets for Score and Questions attempted were met before sitting to take the exam.

Figure 3 : The same SmartPath data can be viewed in graph form, showing how Philip surpassed all targets per course section.

Using SmartPath for the remainder of his CPA Exam journey

Studying Smarter, Not Harder

The release of SmartPath Predictive Technology came just in time for Philip to prepare for the REG Exam — which he was bravely attempting during busy season. As full-time staff accountant during most intense time of the year at a CPA firm, Philip needed to study for this section as quickly and efficiently as possible.

SmartPath provides students with targets that, when reached, indicates readiness to take the exam. The goal metrics used to set these targets are based on the behavior of previous students that passed the CPA Exam with Roger CPA Review.