About The CPA Exam

2023 - 2024

FREE eBook:

CPA Exam Basics

Your 1-stop-shop to CPA requirements, exam content & structure, plus tips to pass!

CPA Review » CPA Exam

Uniform Certified Public Accountant (CPA) Examination is part of the CPA licensing requirements to become a CPA in the US. The CPA Exam evaluates the knowledge and skills needed for newly licensed CPAs (nlCPAs) to practice public accounting. The American Institute of Certified Public Accountants (AICPA), in collaboration with the National Association of State Boards of Accountancy (NASBA) and state boards of accountancy, develops, manages, and scores the exam.

Prometric testing centers administer the CPA Exam throughout the year, and all the sections must be passed within an 18-month rolling period, with a score of 75 or higher for each section. The 18-month rolling window begins once you've passed your first exam section.

The 2023 CPA Exam follows a similar pattern to previous years. However, effective 2024, the CPA Exam will be restructured into a new CPA core-plus-discipline licensure model. This initiative is called the CPA Evolution. The AICPA has released CPA Exam blueprints detailing the content of each section and the changes under the new model.

What To Expect On The 2023 CPA Exam?

The 2023 CPA Exam consists of four sections, each four hours long, with a total test-taking time of 16 hours. Each section focuses on specific subject areas that CPA candidates must learn before obtaining their license. The four exam sections are:

- Auditing and Attestation (AUD): This section covers the auditing procedures per the generally accepted auditing standards, standards related to attest engagements, and the AICPA Code of Professional Conduct.

- Business Environment and Concepts (BEC): This section covers business concepts, the professional obligations of practicing CPAs, and responsibilities in the business environment.

- Financial Accounting and Reporting (FAR): This section requires a strong understanding of US GAAP, financial statement concepts and standards, types of transactions, governmental accounting, and non-governmental accounting and reporting.

- Regulation (REG): This section assesses knowledge and skills in US federal taxation, US ethics and professional responsibilities related to tax practice, and US business law.

What Skills Are Tested On The 2023 CPA Exam?

The CPA Exam framework is based on the AICPA blueprints, which provide a detailed listing of each CPA Exam section. The CPA Exam blueprint incorporates the revised Bloom’s Taxonomy of Educational Objectives, which classify a sequence of skill levels candidates must exhibit when taking the exam. There are around 570 representative tasks that all CPAs must demonstrate when they begin their careers. Each representative task aligns with the four skills indicated below:

- Evaluation: The examination or assessment of problems and use of judgment to draw conclusions.

- Analysis: The examination and study of the interrelationships of separate areas to identify causes and find evidence to support inferences.

- Application: The use or demonstration of knowledge, concepts, or techniques.

- Remembering & Understanding: The perception and comprehension of the significance of an area utilizing knowledge gained.

The four exam sections cover the skill levels at varying levels. It intends to assess the candidate’s performance holistically by looking at subject comprehension, interpretation, application, and retainment. The below table indicates the percentage of skill levels tested in each section and discipline.

| Section | Remembering and Understanding | Application | Analysis | Evaluation |

|---|---|---|---|---|

| AUD | 25-35% | 30-40% | 20-30% | 5-15% |

| BEC | 15-25% | 50-60% | 20-30% | – |

| FAR | 10-20% | 50-60% | 25–35% | – |

| REG | 25-35% | 35-45% | 25-35% | – |

2023 CPA Exam Question Types

Each CPA Exam section contains a varying set of topics, content, question types, and score weightage. There are three main types of questions on the 2023 CPA Exam:

- Multiple Choice Questions (MCQ): MCQs test Remembering & Understanding and Application skills. They require candidates to select the correct answer from a list.

- Task-based Simulations (TBS): TBSs test Application, Evaluation, and Analysis skills. The intent is to simulate real-life work tasks nlCPAs will have to perform in their careers, as opposed to simply selecting the correct answer option.

- Written Communication (WC): WCs test candidates’ writing skills and ability to comprehend and explain concepts.

The table below provides information about the CPA Exam by section, allotted time, and question type.

| Section | Time | MCQs | TBSs | WC |

|---|---|---|---|---|

| AUD | 4 hrs | 72 | 8 | – |

| BEC | 4 hrs | 62 | 4 | 3 |

| FAR | 4 hrs | 66 | 8 | – |

| REG | 4 hrs | 76 | 8 | – |

Score weighting

The below table provides the score weightage of multiple-choice questions (MCQs), task-based simulations (TBSs), and written communication (WC) for each section.

| Section | MCQs | TBSs | WC | WC |

|---|---|---|---|---|

| AUD | 50% | 50% | – | – |

| BEC | 50% | 35% | 15% | 3 |

| FAR | 50% | 50% | – | – |

| REG | 50% | 50% | – | – |

CPA Exam testlets

Each CPA Exam section has five testlets that consist of operational and pretest questions corresponding to each section.

- For AUD, FAR, and REG, the first two testlets consist of multiple-choice questions (MCQs), and the remaining three testlets comprise two to three task-based simulations (TBSs) each.

- For BEC, the last testlet consists of written communication (WC) tasks.

Once completing and submitting a testlet, candidates cannot return to it and must move on to the next testlet. Candidates will receive at least one research-oriented TBS in the AUD, FAR, and REG sections of the exam, requiring them to search through authoritative literature to find appropriate references to answer the question.

| Section | Testlet 1 | Testlet 2 | Testlet 3 | Testlet 4 | Testlet 5 | Total MCQs | Total TBSs | Total WCs |

|---|---|---|---|---|---|---|---|---|

| AUD | 36 MCQs | 36 MCQs | 2 TBSs | 3 TBSs | 3 TBSs | 72 | 8 | – |

| BEC | 31 MCQs | 31 MCQs | 2 TBSs | 2 TBSs | 3 WCs | 62 | 4 | 3 |

| FAR | 33 MCQs | 33 MCQs | 2 TBSs | 3 TBSs | 3 TBSs | 66 | 8 | – |

| REG | 38 MCQs | 38 MCQs | 2 TBSs | 3 TBSs | 3 TBSs | 76 | 8 | – |

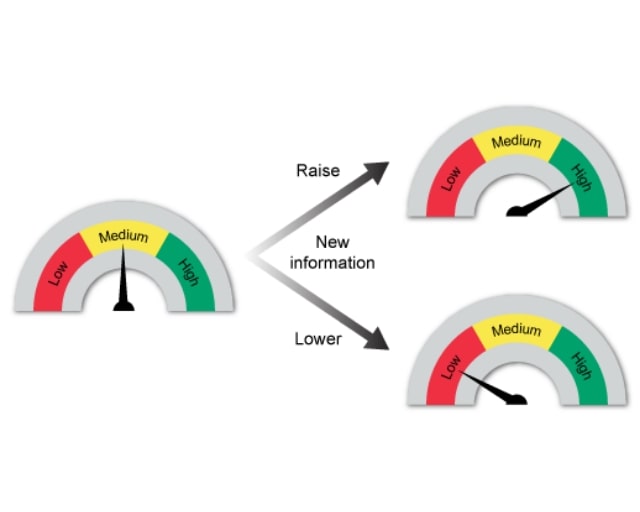

Multiple-choice testlets are presented using the Multistage Testing (MST) process. Hence, when a CPA candidate does well on their first testlet of an exam section, they are subsequently given a testlet with higher difficulty. However, if a candidate performs poorly on the first testlet, a testlet with lower difficulty is presented.

What To Expect On The 2024 CPA Exam?

The 2024 CPA Exam requires all candidates to pass three core exam sections and one discipline exam section as per the candidate’s choice. The overall purpose of this new format is to assess the knowledge and skills required for nlCPAs to function in a technologically advanced world. One major change is that while AUD, FAR, and REG will still be incorporated in the 2024 CPA Exam, making up the three core sections, BEC will no longer be available. Instead, candidates will need to select one of the following discipline sections:

- Business Analysis and Reporting (BAR): For CPA candidates interested in assurance or advisory services, financial statement analysis and reporting, and technical accounting, the BAR discipline is a great option. It includes data analytics and discusses topics such as financial risk management and financial planning techniques.

- Information Systems and Controls (ISC): This discipline lends itself to CPA candidates interested in assurance or advisory services related to business processes, information systems, information security, and IT audits. The ISC discipline focuses on technology and business controls, including IT and data governance, information system security, network security, and endpoint security.

- Tax Compliance and Planning (TCP): The TCP discipline focuses on taxation that involves advanced individual and entity tax compliance. It covers personal financial planning and entity planning, inclusions and exclusions to gross income, and gift taxation compliance and planning.

Providing discipline options allows candidates more flexibility, with the benefit to focus on areas that align with their interests and strengths. However, it’s important to note that no matter which discipline candidates choose, it will still result in one CPA license without mention of the discipline selected.

Practice. Practice. Practice. See what first-rate questions and answers TRULY look like.

What Skills Are Tested On The 2024 CPA Exam?

Based on the AICPA blueprints for the 2024 CPA Exam, there is no change in the skill levels accessed. However, there is a change in the weightage of the skills tested in each core exam section and discipline. The below table indicates the percentage of skill levels tested in each section and discipline.

| Section | Remembering and Understanding | Application | Analysis | Evaluation |

|---|---|---|---|---|

| AUD – Core | 30-40% | 30-40% | 15-25% | 5-15% |

| FAR – Core | 5-15% | 45-55% | 35-45% | – |

| REG – Core | 25–35% | 35–45% | 25–35% | – |

| BAR – Discipline | 10–20% | 45–55% | 30–40% | – |

| ISC – Discipline | 55–65% | 20–30% | 10–20% | – |

| TCP – Discipline | 5–15% | 55–65% | 25–35% | – |

2024 CPA Exam Question Types

Each CPA Exam section covers a range of topics with different question types, and the score weightage is allotted accordingly. For the 2024 CPA Exam, there will be only two main types of questions with varying weightage in each section: multiple-choice questions and task-based simulations. Written communication, previously included in BEC, will not be a part of the 2024 CPA Exam. The table below provides information about the 2024 CPA Exam by section, allotted time, and question type.

| Section | Section Time | Multiple-Choice Questions (MCQs) | Task-based Simulations (TBSs) |

|---|---|---|---|

| AUD – Core | 4 hours | 78 | 7 |

| FAR – Core | 4 hours | 50 | 7 |

| REG – Core | 4 hours | 72 | 8 |

| BAR – Discipline | 4 hours | 50 | 7 |

| ISC – Discipline | 4 hours | 82 | 6 |

| TCP – Discipline | 4 hours | 68 | 7 |

Score weighting

With only MCQs and TBSs for each exam section, there is a change in the score weightage for the 2024 CPA Exam, as shown in the table below.

| Section | Multiple-Choice Questions (MCQs) | Task-based Simulations (TBSs) |

|---|---|---|

| AUD – Core | 50% | 50% |

| FAR – Core | 50% | 50% |

| REG – Core | 50% | 50% |

| BAR – Discipline | 50% | 50% |

| ISC – Discipline | 60% | 40% |

| TCP – Discipline | 50% | 50% |

CPA Exam testlets

Each CPA Exam section has five testlets with MCQs in the first two testlets, and TBSs in the remaining three testlets. The below table depicts how these question types are distributed throughout each exam section.

| Section | Testlet 1 MCQs | Testlet 2 MCQs | Testlet 3 TBSs | Testlet 4 TBSs | Testlet 5 TBSs | Total MCQs | Total TBSs |

|---|---|---|---|---|---|---|---|

| AUD – Core | 39 | 39 | 2 | 3 | 2 | 78 | 7 |

| FAR – Core | 25 | 25 | 2 | 3 | 2 | 50 | 7 |

| REG – Core | 36 | 36 | 2 | 3 | 3 | 72 | 8 |

| BAR – Discipline | 25 | 25 | 2 | 3 | 2 | 50 | 7 |

| ISC – Discipline | 41 | 41 | 1 | 3 | 2 | 82 | 6 |

| TCP – Discipline | 34 | 34 | 2 | 3 | 2 | 68 | 7 |

What Order Should You Take The CPA Exam

As we transition from the 2023 to 2024 CPA Exam, our regular recommendations for CPA Exam order do not apply. This is because the sequence that makes sense for you is very dependent on your personal situation. When determining your game plan, it’s important to understand the CPA Exam Transition Policy that has been announced by NASBA:

- If you can sit for all four CPA Exam sections before 2024, go ahead. You need not worry about the changes.

- If you pass any sections before the changes occur, those credits still count! AUD, FAR, and REG will transfer over to their 2024 exam section counterparts. If you’ve passed BEC, this credit will carryover and you will not need to take one of the new discipline sections.

This flexibility built into the exam transition policy allows you to take the sections based on your preference. Checkout our series of recommended CPA Exam pathways to consider no matter when you plan to start.