About REG CPA Exam

[Updated for 2023 - 2024]

CPA Exam Basics

Your 1-stop-shop to CPA requirements, exam content & structure, plus tips to pass!

CPA Review » CPA Exam » About the REG CPA Exam

The Regulation (REG) CPA Exam section assesses a candidate's knowledge and skills in U.S. federal taxation, U.S. ethics and professional responsibilities related to tax practice, and U.S. business law. REG, like all other sections of the CPA Exam, is administered by the American Institute of Certified Public Accountants (AICPA).

According to the AICPA Blueprints, federal taxation accounts for more than 60% of the REG Exam. The remaining topics tested in the REG Exam include: business law, business ethics, and professional and legal responsibilities.

The REG section of the CPA Exam in 2024 is set to undergo extensive changes. As a core section of the exam, the focus will shift toward technology-related knowledge and skills. These changes will include significant alterations to the format, structure, and content areas of the REG CPA Exam.

What is the 2023 REG CPA Exam Format & Structure?

Before taking the exam, it is important to understand the REG Exam format and structure. Therefore, let’s delve further into the framework to better prepare you for the FAR CPA Exam.

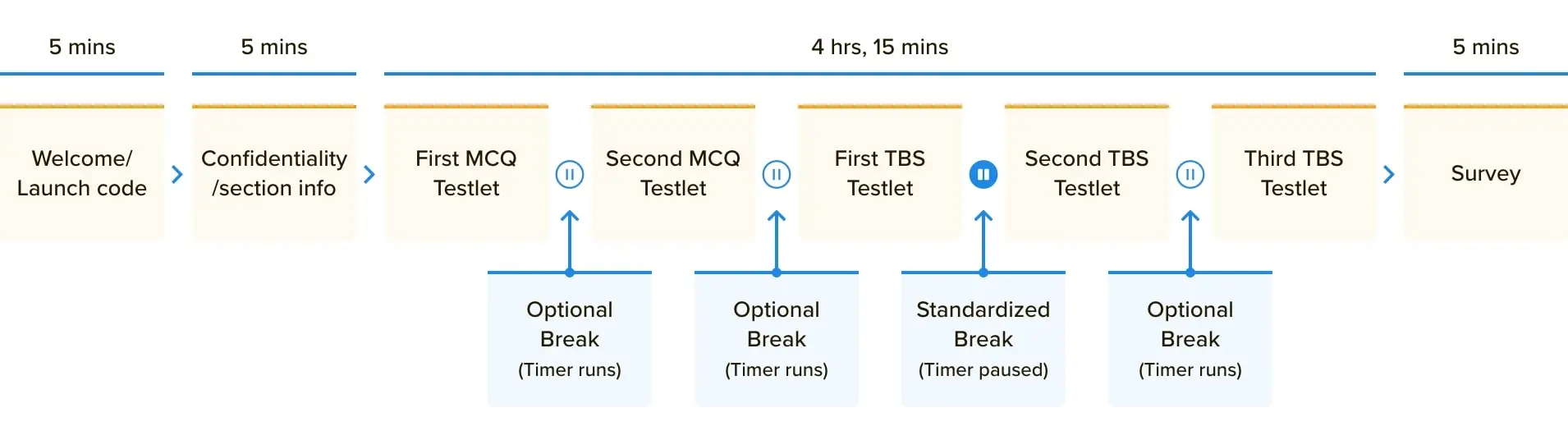

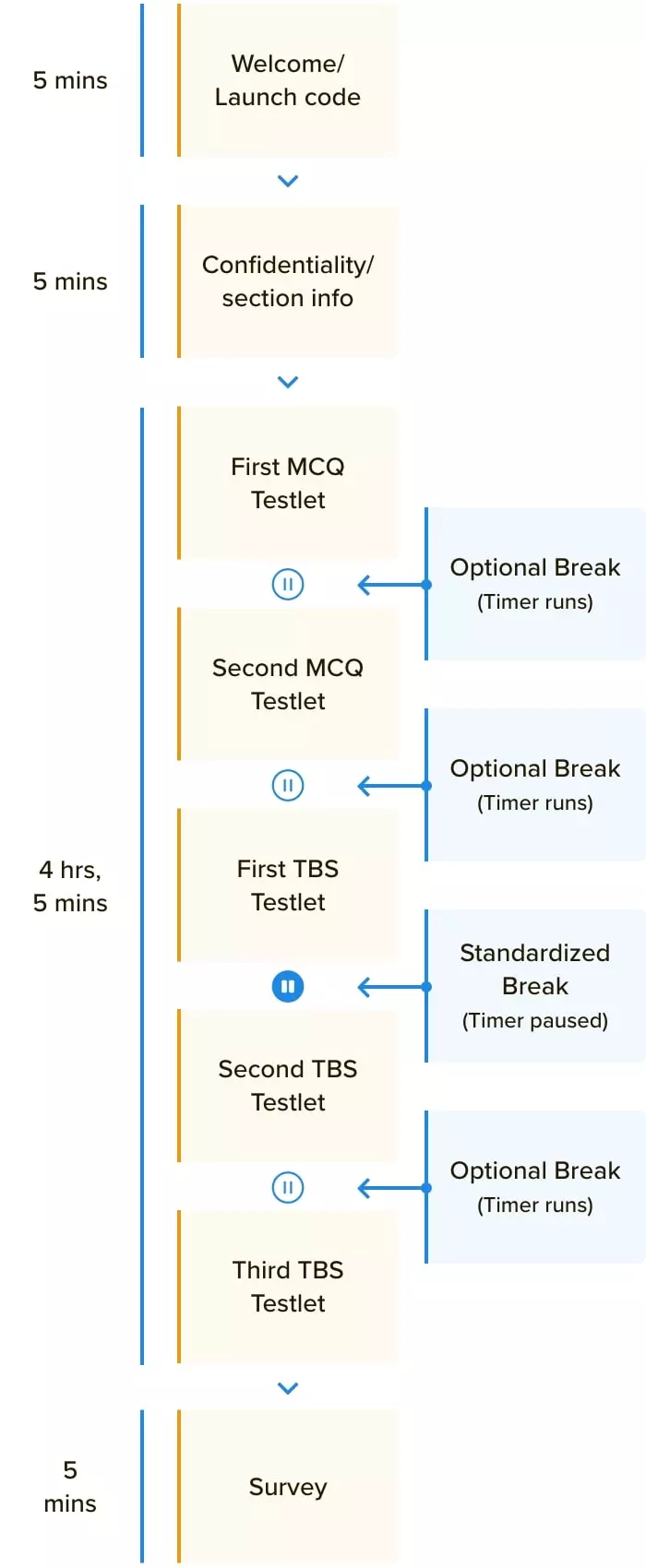

Pre-Exam

At the start of the testing session, you will be given 2 sets of welcome screens. The first of these displays will ask for confirmation of your name, ID, exam portion, and launch code. Before moving on, you must accept the confidentiality declarations on the next screen. It’s vital to remember that if you don’t address these screens in under 5 minutes each, your exam will be canceled and you won’t be able to continue.

Exam

The exam is organized into 5 testlets. Operational and pretest questions are included in these testlets. Pretest questions are not scored, but operational questions are. The REG exam is composed of multiple-choice questions (MCQs) and task-based simulations (TBSs). There are no Written Communication (WC) questions on the REG exam. Each testlet contains questions from only one of these question types:

- Multiple-Choice Questions (MCQ) – One question with four potential answers. MCQs make up 50% of the REG exam.

- Task-Based Simulations (TBS) – Questions that require you to apply practical knowledge. This could include filling out a document or finishing a research question. TBSs make up 50% of the REG Exam.

The first 2 testlets on the REG Exam consist of MCQs, with 38 questions per testlet. This is a total of 76 multiple choice questions (MCQs). 64 of the 76 MCQs are operational, meaning they count toward the exam score, whereas the remaining 12 are pretested and do not count toward the exam score.

The remaining 3 testlets consist of TBSs. Each testlet contains 2-3 task-based simulations.There is a total of 8 task-based simulations on the REG Exam. Seven of the eight TBSs are operational, and one is pretested. Apart from scoring, there is no practical difference between operational and pretested questions, and there is no clear method for the applicant to distinguish between the two.

An optional 15-minute break that does not count towards the 4-hour test period is provided after the 3rd testlet.

Post Exam

Following the completion of the exam, you will be asked to complete a 5-minute survey requesting feedback about your exam experience.

How To Manage Your Time in the 2023 REG CPA Exam?

Understanding how much time you have to complete the REG Exam will help you construct a smart game plan for exam day.

- Before you start the exam, you will view a welcome screen, in which you must enter your launch code and confirm information within a 5-minute period.

- The next set of welcome screens includes confidentiality statements that you have to accept within 5 minutes as well.

- There are optional breaks between each testlet. However, during these optional breaks, the timer continues to run and counts toward your total exam time.

- There is a 15-minute optional standard break that occurs after you complete the third testlet. It is highly recommended that you take advantage of this break as it does not count against your exam time.

- Finally, there will be a 5-minute survey post exam.

The CPA REG Exam testing time is a total of 4 hours. Here is the amount of time we recommend you spend on each question, based on the question type:

- 76 Multiple-choice Questions: 1.25 minutes each

- 8 Task-Based Simulations: 18 minutes each

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 38 MCQ | 45 Minutes |

| Testlet 2 | 38 MCQ | 45 Minutes |

| Testlet 3 | 2 TBS | 36 Minutes |

| 15 minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 54 Minutes |

| Testlet 5 | 3 TBS | 54 Minutes |

| Extra Time | 6 minutes | |

| Total Time | 240 minutes | |

What Topics Are Tested in the 2023 REG CPA Exam?

The AICPA CPA Exam Blueprint lays out the knowledge, skills, and subject themes candidates will be expected to know for the CPA Exam. It also contains information about adjustments or changes that will be implemented each year. The CPA Exam Blueprints provide a detailed description of each exam section, allowing applicants to better understand what they need to study in order to pass the exam.

The REG section of the CPA Exam primarily focuses on federal taxation. According to the AICPA Blueprints, this overarching topic area makes up more than 60% of the REG Exam. The remaining topics include: business law, business ethics, and professional and legal responsibilities.

- Federal taxation of individuals

- Federal taxation of entities

- Federal taxation of property transactions

- Contracts

- Agency

- Business structure

- Debtor-creditor relationships

- Government regulation of business

- Ethics and responsibilities in tax practice

- Licensing and disciplinary systems

- Federal tax procedures

- Legal duties and responsibilities

What Skills Are Tested on the 2023 REG CPA Exam?

The skills tested on the CPA Exam are based on a revised Bloom’s Taxonomy of Educational Objectives. From this range of skill levels, the REG Exam tests candidates at the following skill levels: remembering & understanding, application, analysis, and evaluation.

is the observation and understanding of the significance of an area utilizing knowledge gained.

is the investigation of the interrelationships of separate areas to identify causes and find confirmation to support implications.

is the use or exhibition of knowledge, concepts,

or techniques.

- Area I and Area II focus on remembering and understanding. Since these two areas contain professional responsibilities, general ethics, and business law, they require candidates to demonstrate a high level of retention.

- In Areas III, IV, and V, application and analysis skills are predominantly evaluated. This is because these three areas deal with the daily tasks a CPA will encounter while in their position.

What Is the 2024 REG Exam Format and Structure?

As we have already mentioned, the 2024 REG CPA Exam has slight changes in the format and structure. The total exam duration remains at 4 hours, with a total of 5 testlets to complete. However, there has been a change to the number of questions in each testlet.

The first two testlets are multiple-choice questions (MCQs), with each testlet containing 36 MCQs. In total, candidates will need to answer 72 MCQs. The remaining three testlets are task-based simulations (TBS). The third testlet includes 2 TBS, while the other two testlets each have 3 TBS to answer.

| 2024 REG CPA Exam Structure | |

|---|---|

| Total Time | 4 Hours |

| Multiple Choice Questions | 72 |

| Task Based Simulations | 7 |

The new format and structure of the 2024 REG CPA Exam call for a better time management strategy. This chart shows that adding these changes to your exam strategy will help you optimize your time.

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 36 MCQ | 47 Minutes |

| Testlet 2 | 36 MCQ | 47 Minutes |

| Testlet 3 | 2 TBS | 36 Minutes |

| 15 minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 54 Minutes |

| Testlet 5 | 3 TBS | 54 Minutes |

| Extra Time | 2 minutes | |

| Total Time | 240 minutes | |

What Topics Are Tested in the 2024 REG CPA Exam?

- Ethics and responsibilities in tax practice

- Licensing and disciplinary systems

- Federal tax procedures

- Legal duties and responsibilities

- Agency

- Contracts

- Debtor-creditor relationships

- Federal laws and regulations (employment tax, qualified health plans, bankruptcy, worker classifications and anti-bribery)

- Business structure

- Basis of assets

- Cost recovery (depreciation and amortization)

- Gross income (inclusions and exclusions)

- Reporting of items from pass-through entities

- Adjustments and deductions to arrive at adjusted gross income and taxable income

- Loss limitations

- Filing status

- Computation of tax and credits

- Differences between book and tax income (loss)

- C corporations

- S corporations

- Partnerships

- Limited liability companies

- Tax-exempt organizations

What Skills Are Tested on the 2024 REG CPA Exam?

Starting January 2024, the CPA Exam will continue to follow the revised Bloom’s Taxonomy of Educational Objectives. As seen in the below table, the weight of the different score areas will remain the same between the current and future REG Exam.

is the investigation of the interrelationships of separate areas to identify causes and find confirmation to support implications.

is the observation and understanding of the significance of an area utilizing knowledge gained.

is the use or exhibition of knowledge, concepts,

or techniques.

Master the most complex CPA Exam section when you study smarter, not harder with UWorld.

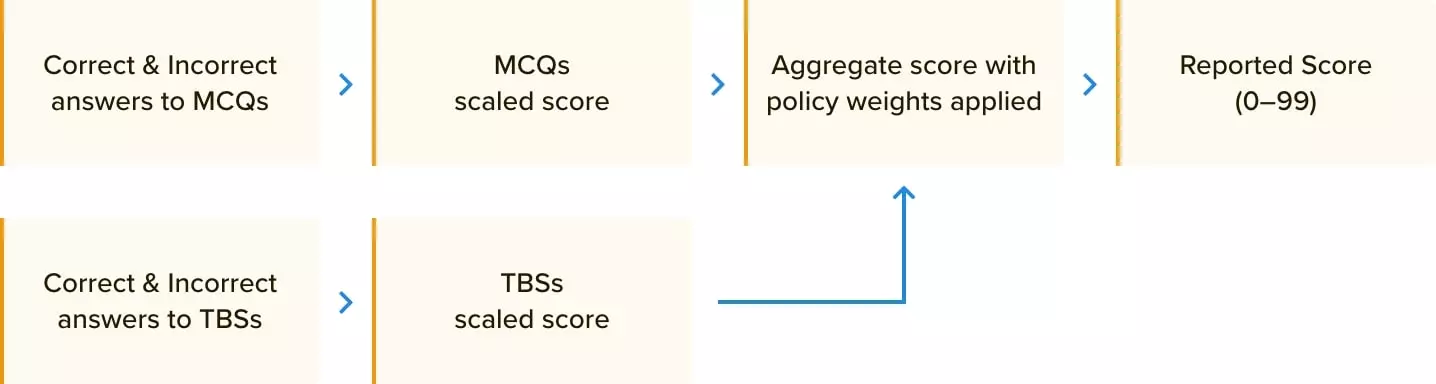

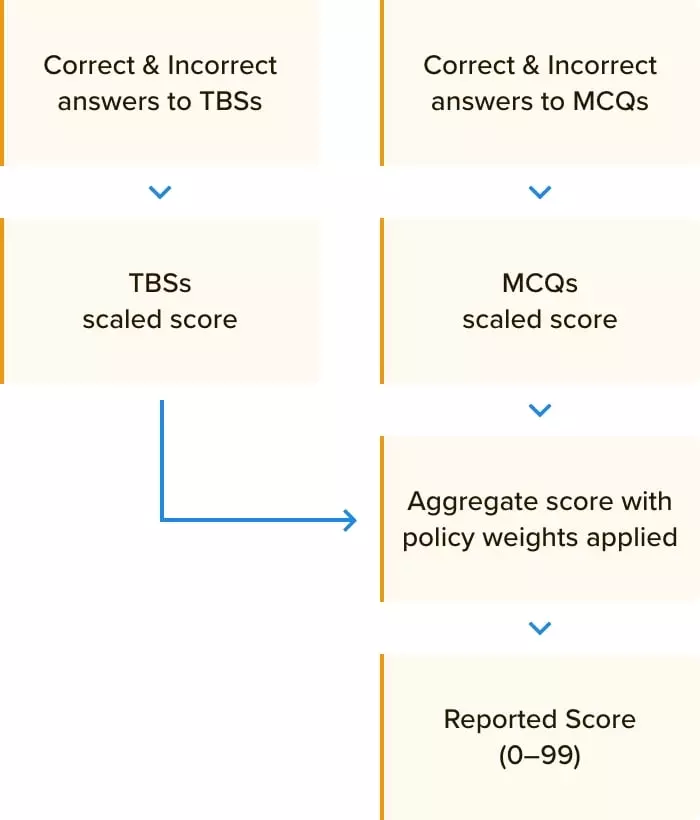

How is the REG CPA Exam Scored?

Scores for the REG Exam are given on a scale of 0 to 99. Candidates need a score of 75 or higher to pass. These aren't percentages, and they shouldn't be treated as such. Scaled scores on the exam's MCQs and TBSs are determined using algorithms that take into account whether the question was successfully answered, as well as the difficulty level of each question.

For example, a candidate who answers 10 difficult questions correctly will receive a higher score than a candidate who answers 10 easy (lower value) questions correctly. Therefore, answering 75% of the questions on the exam correctly does not translate into a score of 75. There are many factors that go into a CPA Exam Score. Learn more about how the CPA Exam is scored here.

The first half of a candidate's REG Exam score is made up of MCQs, while the second half is made up of TBSs. The weight of a candidate's final score will be evenly allocated between MCQs and TBSs. This means that weightage for MCQs and TBSs are 50% each.

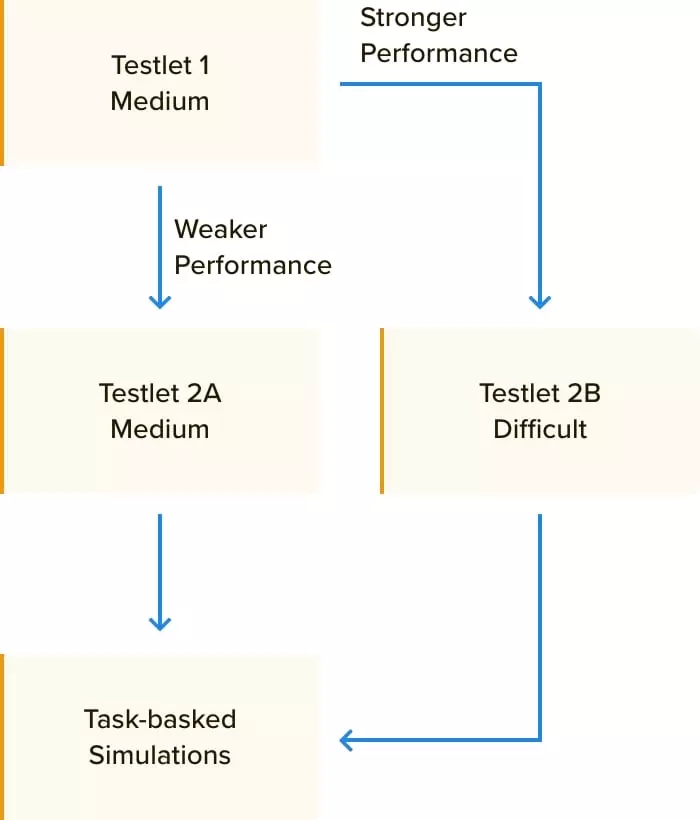

The REG Exam uses a process called multi-state adaptive testing. With this, the first MCQ testlet is set to 'medium' difficulty by default. The following MCQ testlet's difficulty level is determined by the candidate's performance on the first REG testlet. As a result, the candidate’s second MCQ testlet will be set to one of the following difficulty sequences:

- Difficult - Candidate performed well on the first testlet

- Moderate - Candidate did not perform well on the first testlet

The average difficulty of the questions in an MCQ testlet is described as 'medium' or 'difficult' for the REG Exam testlet. Each MCQ does not have a binary 'difficulty' or 'medium' value attached to it. Rather, each question's difficulty is measured on a quantitative scale.

Credit for the REG Exam MCQs is weighted by difficulty level; candidates who answer more difficult questions correctly receive more credit than answering less difficult questions correctly. As a result, a candidate with a difficult testlet is neither punished for having more difficult questions, nor is having two medium difficulty testlets advantageous.

Even with a Medium-Medium MCQ testlet sequence, it is feasible to pass the REG Exam. In these circumstances, passing requires a good-to-excellent score on the second MCQ testlet and the TBS testlets.

The REG Exam TBS testlets are pre-selected and have no bearing on the candidate's performance on the previous MCQ testlets, nor do the TBSs within the TBS testlets continue in accordance with the previous TBS.

While an MCQ can be answered correctly or incorrectly, non-research based TBSs receive partial credit. Research-based TBSs are assessed as correct or incorrect, with no partial credit provided.

REG CPA Exam Pass Rates

Students perceive the CPA Exam's Regulation section to be difficult due to the large quantity of non-accounting content presented in the exam, which includes tax law and company law. However, in 2022, REG has a cumulative pass rate of nearly 60%. This is the highest pass rate among all the CPA Exam sections. Here’s a look at the REG CPA Exam pass rates over the years:

The AICPA publishes the average CPA Exam Pass Rates, broken down by section, every quarter. The overall pass rate varies slightly by region and quarter, but it tends to settle around 45-55%. View the pass rates for each section of the CPA Exam from prior years in CPA Exam Pass Rates.

How To Study for the REG CPA Exam Section?

We estimate approximately 84-112 hours of study are required in order to pass REG, but each student is unique and has their own time requirements.

The order in which a candidate takes the four sections of the CPA Exam will vary depending on several individual factors. REG is the most standalone of all four sections and can be taken at any time during your CPA Exam process.

Establishing a study plan and sticking to it is essential to passing the CPA Exam. Break up your study topics and content areas into small pieces, and give each section a certain amount of time to study. The best way to prepare for the REG CPA Exam is to read every chapter of your study material. Soon, you will identify which topics need the most attention and work accordingly.

Practice, practice, practice. Make sure your CPA review course includes access to top quality MCQs and TBSs that match the content and format of the actual REG Exam.

Time management is key to your success on the REG Exam. You can hone this skill by completing practice exams with a timer. This will make you conscious of the time, allowing you to build on your pace and effectively manage time throughout the exam.

A CPA Review course will help you effectively study for the CPA Exam. The UWorld Roger CPA Review course has customizable quizzes and digital flashcards with spaced-repetition technology to help you learn efficiently.

REG CPA Exam Study Tips

We recommend using some of the study techniques listed below:

- Make a study regimen and a game plan you can stick to.

- Say "no" to distractions to safeguard your study time.

- Consider eliminating distractions during your designated study times – block Internet access, turn off notifications, tell family, friends and colleagues you will be completely unavailable.

- Solicit help from relatives and friends.

- Get plenty of rest, eat healthy, and exercise often.

- Keep your sights set on the finish line and remember why you're on this adventure.

- Gain an understanding of the regulation process by drawing on real-world experience.

- Expand your understanding of internal control.

- To increase your mastery, practice carefully on the portions you believe are your weakest.

Whether you're a fresh college graduate or a seasoned professional, the secret to passing the CPA Exam is to assess your priorities, create a solid CPA study plan, and take the first step toward your objectives. Year after year, applicants state that procrastination and study time management are the most difficult obstacles they face in passing the CPA Exam. Read on for our best advice on how to make your own study strategy and get started on the road to becoming a CPA here: CPA Exam Study Guide.

Master the concepts easier with effective answer explanations and visuals

Frequently Asked Questions (FAQs)

How hard is the REG CPA Exam?

In which order should I take REG among the four sections of the CPA Exam?

How many hours do I need to study to pass the REG CPA Exam?

What should I focus on for the REG CPA Exam?

Is the REG section changing in the 2024 CPA Exam?

The CPA Exam is undergoing extensive changes starting January 2024 as part of the CPA Evolution. The AICPA developed the 2024 CPA Evolution in association with NASBA to retain the CPA Exam’s credibility by modifying it to reflect the constantly advancing skills and competencies required for the profession.

In this new core-plus-discipline model, the CPA Exam will have 3 core sections that will be taken by all candidates. It will also have 3 discipline sections, of which candidates will select only one section. The REG Exam will be considered one of the Core CPA Exam sections in 2024.